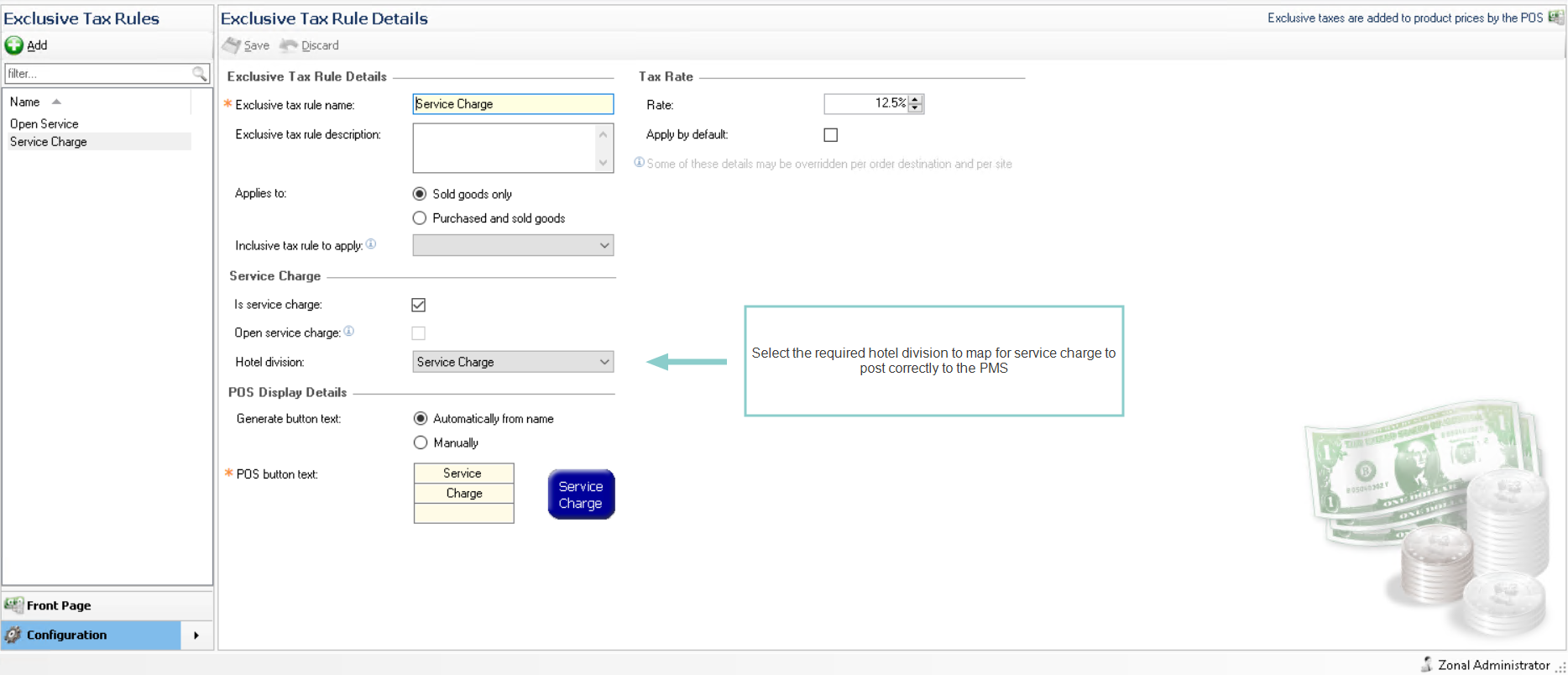

When using a Hotel Interface and service charge is in use a hotel division must be created and then assigned to the tax rule so that the correct account totals are sent to the PMS when any room / non-room charges are made.

-

Select Finance from the Aztec Start Page

-

Select Configuration | Exclusive Tax Rules, the tax rule details screen will be displayed

-

From the list select the required tax rule(s), and in the Service Charge section select the required Hotel Division from the drop down

To be able to select a hotel division the tax rule must me "Service Charge" enabled with either "Is Service Charge" or "Open Service Charge"

-

Click Save

Remember to assign the hotel division to all service charge tax rules setup

If the hotel division assigned to service charge is also assigned to another sub-category all sales under this sub-category will be charged to the PMS as service charge